Evolution Of Online Instant Loans: Cash At Your Fingertips

In the digital age, the financial landscape has experienced a significant transformation, particularly in the realm of lending. Online instant loans have emerged as a revolutionary solution, offering quick access to funds for individuals facing urgent financial needs. This evolution has revolutionized the borrowing experience, providing fast, convenient, and efficient access to funds at the touch of a button.

Emergence of Online Instant Loans:

The introduction of online instant loans has disrupted traditional lending practices & helps you to get loan instantly. These loans, accessible through dedicated apps or websites, provide swift approval and disbursal of funds, meeting the immediate financial requirements of borrowers.

Speed and Convenience:

The defining characteristic of online instant loans is their speed. The application process is streamlined, often requiring minimal documentation and allowing borrowers to apply from the comfort of their homes. The approval and disbursal process is expedited, with funds often reaching the borrower’s account within hours.

Simplified Application Procedures:

Online instant cash loan applications are user-friendly and straightforward. Borrowers are guided through simple steps requiring basic personal and financial information. Some apps use AI and algorithms to automate the approval process, ensuring quick decisions based on predefined criteria.

Minimal Documentation and Credit Checks:

These loans often involve minimal documentation, reducing the hassle of lengthy paperwork. Additionally, some lenders offer loans without stringent credit checks, making them accessible to individuals with varying credit profiles.

Diverse Loan Products:

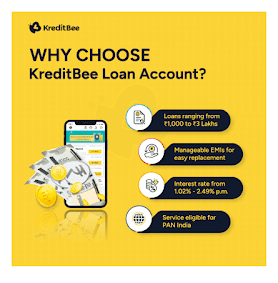

Online instant loans come in various forms, including personal loans, payday loans, small-ticket loans, and installment loans. This diversity caters to different financial needs, offering flexibility in loan amounts and repayment terms.

24/7 Accessibility:

The online nature of these loans ensures round-the-clock accessibility. Borrowers can apply for an instant personal & business loan online at any time, eliminating the constraints of traditional banking hours.

Emergence of Fintech Companies:

Fintech companies have played a very crucial role in the evolution of online instant loans. By leveraging technology and innovative solutions, these companies have disrupted the lending industry, introducing faster and more efficient borrowing options.

Addressing Urgent Financial Needs:

An online instant or fast loan serves as a lifeline for individuals facing urgent and unexpected financial challenges, such as medical emergencies, car repairs, or unforeseen expenses. The quick access to funds alleviates immediate financial stress.

Educating Borrowers:

These platforms often provide educational resources to assist borrowers in understanding the implications of borrowing, managing debt responsibly, and making informed financial decisions.

Regulatory Framework and Consumer Protection:

Regulatory bodies work to ensure consumer protection by overseeing these online lending practices. Guidelines and regulations are set to maintain ethical lending practices, transparency, and fair interest rates for borrowers.

The evolution of any online flexi loan marks a significant shift in the borrowing landscape. These loans offer unparalleled speed, convenience, and accessibility, providing a swift financial solution for immediate needs. However, while they serve as a viable option for urgent requirements, borrowers must exercise caution, understand the terms, and borrow responsibly to avoid potential financial strain.

The continued evolution of these lending mechanisms, guided by regulations and technological advancements, continues to reshape the borrowing experience, providing a faster and more efficient means of obtaining funds.